WHATS A GOOD AR TURNOVER RATIO PLUS

You take this net credit sales number and divide it by the average accounts receivable - the accounts receivable at the beginning of the year plus end of the year divided by two - to arrive at 8.75 for your accounts receivable turnover ratio.

Subtracting $10,000 in credit sales returns from $150,000 in total credit sales results in net credit sales of $140,000.

Accounts receivable turnover in days = 365 / 8.75 = 47.71.Average accounts receivable = (Beginning accounts receivable + Ending accounts receivable) / 2.Net credit sales = Gross credit sales – Sales returns – Sales allowances.Here is the formula for accounts receivable turnover ratio spelled out in more detail: What’s more, based on the receivable turnover in days determined here, the average customer takes just under 42 days to pay their debt to the store - the purchase they made on credit. This means that Company ABC collected its average accounts receivable roughly 8.75 times over the fiscal year ending Dec. Learn: 6 Invoicing Best Practices for Small and Midsize Businessesįor this company, the accounts receivable turnover ratio is 8.75. Income Statement and Accounts Receivable Turnover Below, you’ll find a table that breaks down an example for calculating the accounts receivable turnover ratio and receivable turnover in days based on a simplified income statement for a hypothetical business. This shows the average number of days that it takes a customer to pay your company for sales on credit. Receivable turnover in days = 365 / Receivable turnover ratio However, not all companies report cash and credit sales separately.Ī further step you can take once you have the accounts receivable turnover ratio is determining the accounts receivable turnover in days. Often, you can find a business’s net credit sales in the company’s income statement for the year. See: 6 Invoice Factoring Options for Your Business Average Accounts Receivable: The sum of starting and ending accounts receivable over a time period, such as monthly, quarterly or yearly, divided by two.To determine net credit sales, take your total sales on credit and subtract sales returns and sales allowances. Net Credit Sales: These are sales where the cash is collected at a later date, which equals a form of credit.The accounts receivable turnover ratio formula looks like this:Īccount receivables turnover ratio = Net credit sales / Average accounts receivable The concept of net sales is pretty straightforward, referring to sales minus returns and refunded sales. Only credit sales create a receivable, which is why cash sales are excluded from the calculation. Net credit sales are used instead of net sales because cash sales don’t create receivables. To calculate the accounts receivable turnover ratio, divide net credit sales by the average accounts receivable for that period.

WHATS A GOOD AR TURNOVER RATIO HOW TO

How To Calculate Accounts Receivable Turnover Ratio On a broader level, the accounts receivable turnover ratio shows how well a company uses and manages the credit it extends to its customers and clients, as well as how quickly that short-term debt is collected or is paid.

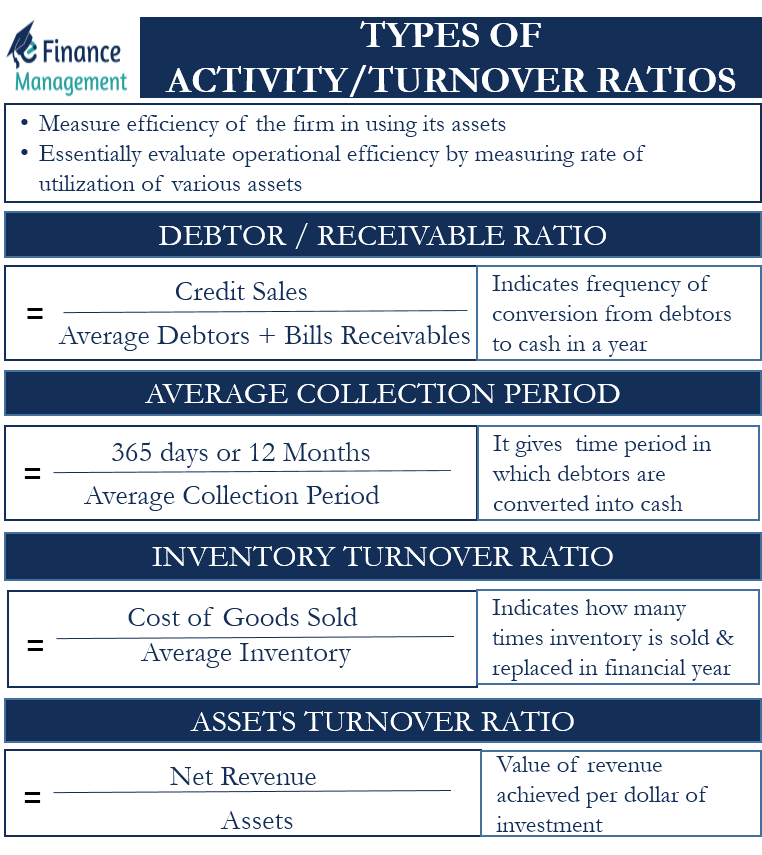

Put another way, the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year. Accounts receivable turnover ratio is a type of efficiency ratio that measures how many times a business can turn its accounts receivable into cash during a given period. An efficiency ratio is used to measure how well a company is utilizing its assets and resources. What Is Accounts Receivable Turnover Ratio?īefore defining what accounts receivable turnover ratio is, it’s best to define what an efficiency ratio is. Read on to find out what accounts receivable ratio is and how to calculate it for your business.

On a company balance sheet, accounts receivables are listed as current assets.Ĭlosely related to accounts receivable is what’s called the accounts receivable turnover ratio, which is significant to measuring a company’s performance. Accounts receivable is considered a form of credit because the company doesn’t get the cash upfront for the customer’s purchase. A very important concept for a business of any size is accounts receivable - or the balance of money due for goods or services sold to customers that have not yet been paid for.

0 kommentar(er)

0 kommentar(er)